[ad_1]

Curious about what lies ahead for the euro? Explore all the insights in our Q1 trading forecast. Request your free copy now!

Recommended by Diego Colman

Get Your Free EUR Forecast

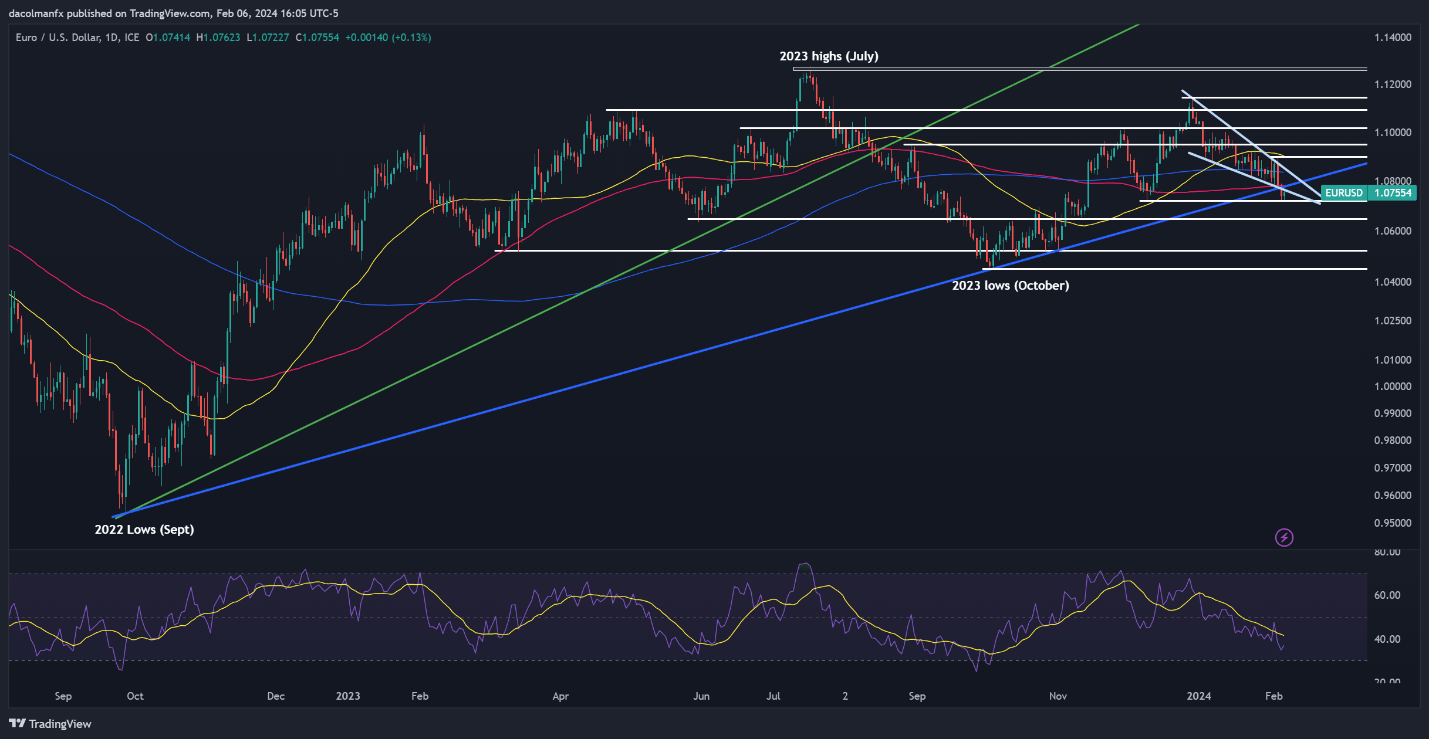

EUR/USD TECHNICAL ANALYSIS

EUR/USD perked up on Tuesday after bouncing from a key floor slightly above the 1.0700 mark, with prices approaching cluster resistance at 1.0780. If the bulls manage to take out this technical barrier in the coming days, we could see a move toward the 200-day simple moving average at 1.0840.

In contrast, if sellers return and drive the pair below horizontal support at 1.0720, bearish pressure could intensify, exposing the 1.0650 region. The pair is likely to start a bottoming-out phase around these levels before staging a turnaround, but in the event of a breakdown, a rapid move towards 1.0524 could ensue.

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Using TradingView

Keen to understand how FX retail positioning can provide hints about the short-term direction of GBP/USD? Our sentiment guide holds valuable insights on this topic. Download it today!

| Change in | Longs | Shorts | OI |

| Daily | -14% | 25% | -1% |

| Weekly | 25% | -4% | 11% |

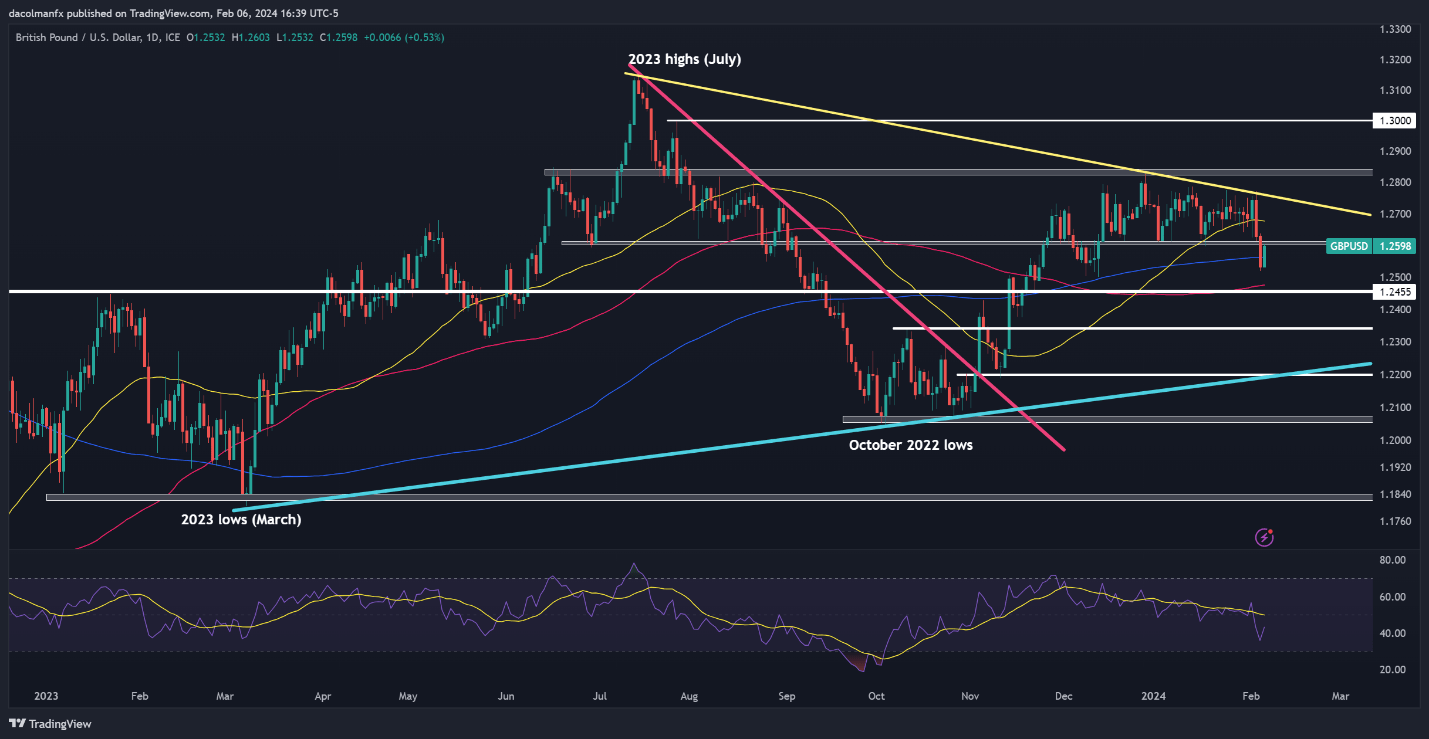

GBP/USD TECHNICAL ANALYSIS

After Monday’s selloff, GBP/USD rebounded on Tuesday, climbing past its 200-day SMA but falling just shy of recapturing the 1.2600 handle. We cannot definitively state that this ceiling will hold, but if it does, sellers could resume their offensive, paving the way for a drop towards 1.2560, followed by 1.2455.

On the other hand, if cable manages to breach resistance at 1.2600, breakout traders may be enticed to jump in, reinforcing the upward push and creating optimal conditions for a rally towards the 50-day simple moving average at 1.2680. On further strength, all eyes will be on trendline resistance at 1.2750.

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Using TradingView

Want to explore how retail positioning can mold the short-term direction of USD/CAD? Our sentiment guide offers valuable insights. Download your complimentary guide today!

| Change in | Longs | Shorts | OI |

| Daily | 6% | -5% | 0% |

| Weekly | -20% | 25% | 0% |

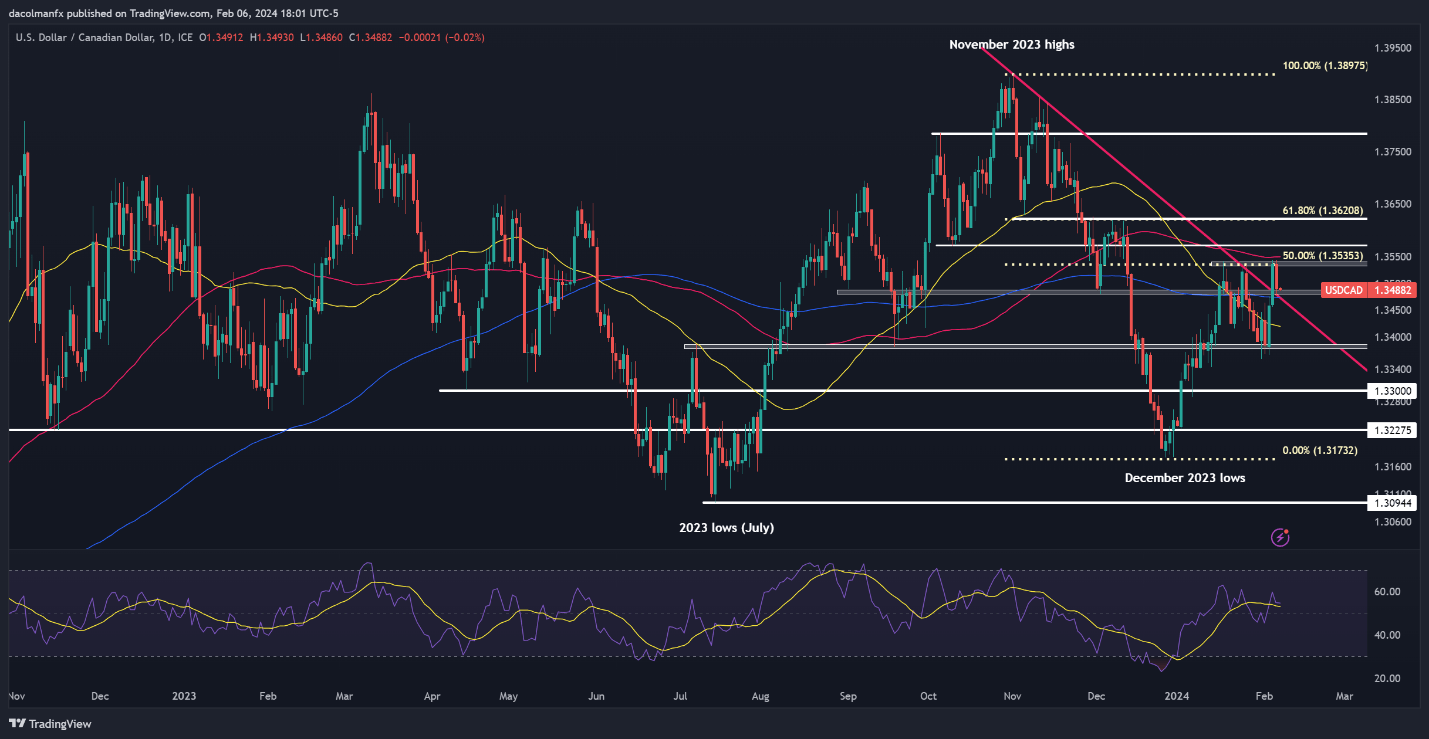

USD/CAD TECHNICAL ANALYSIS

USD/CAD fell sharply on Tuesday after failing to break above confluence resistance at 1.3535, a key area where multiple previous swing highs align with the 50% Fib retracement of the Nov/Dec slump. If the decline gains steam in the coming days, support awaits around the 200-day SMA near 1.3475. Subsequent losses could shift the spotlight to the 50-day SMA at 1.3420, followed by 1.3380.

Conversely, in the event that the pair embarks on a bullish reversal from its present position, the first ceiling to watch emerges at 1.3535, as previously highlighted. Moving higher, the crosshairs will be locked onto 1.3575 and then 1.3620.

USD/CAD TECHNICAL CHART

USD/CAD Chart Created Using TradingView

Eager to discover what the future may have in store for the Japanese yen? Find comprehensive answers in our quarterly trading forecast. Claim your free copy now!

Recommended by Diego Colman

Get Your Free JPY Forecast

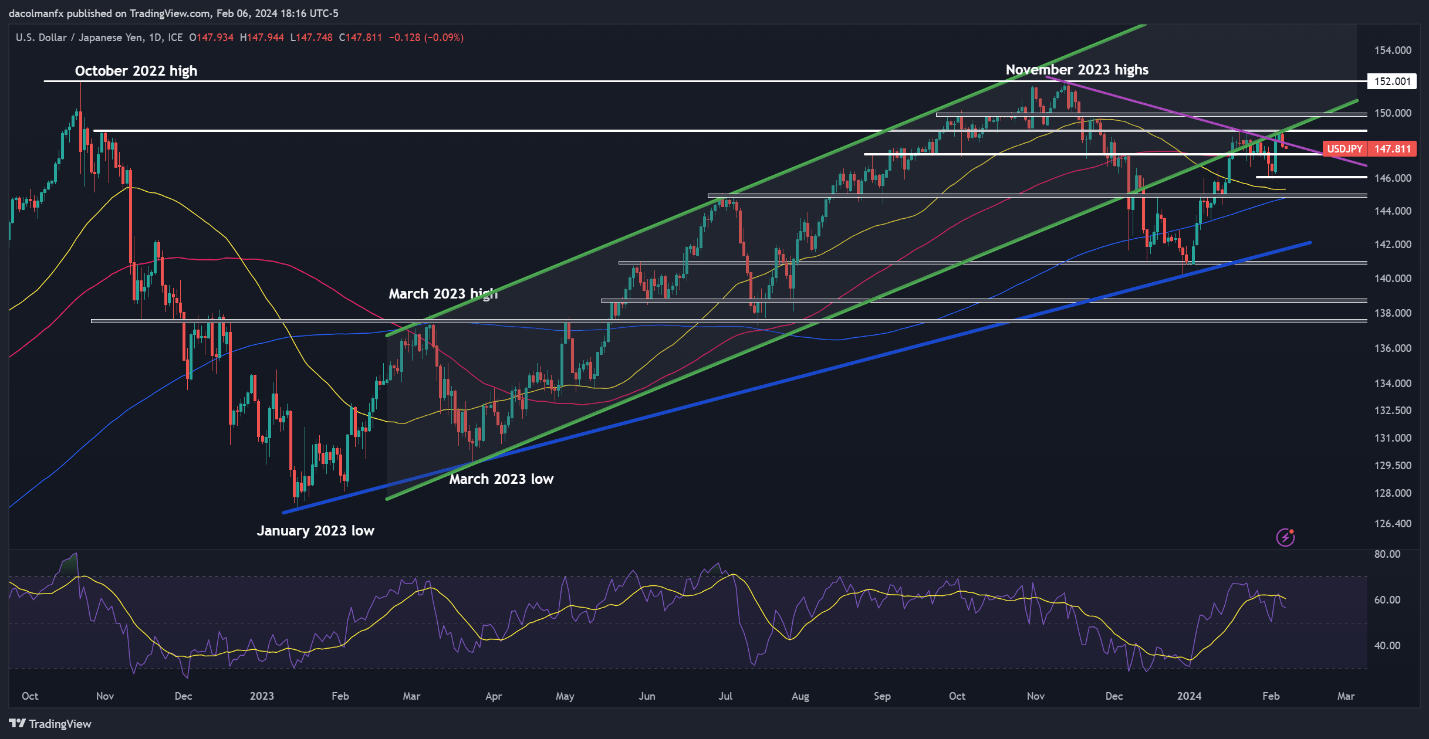

USD/JPY TECHNICAL ANALYSIS

USD/JPY suffered a setback on Tuesday following a bearish rejection at technical resistance near 148.90, with the pullback seemingly amplified by falling U.S. yields. If weakness persists later this week, support is located at 147.40. Below this area, the next significant floor to consider emerges at 146.00.

On the other hand, if the bulls regain control, which appears to be a strong possibility given the improved U.S. dollar outlook stemming from the Fed’s reluctance to deliver premature rate cuts, resistance looms at 148.90, followed by 150.00. In case of further gains, attention will be directed towards 152.00.

USD/JPY TECHNICAL CHART

[ad_2]

Source link