[ad_1]

USD/CAD Technical Outlook

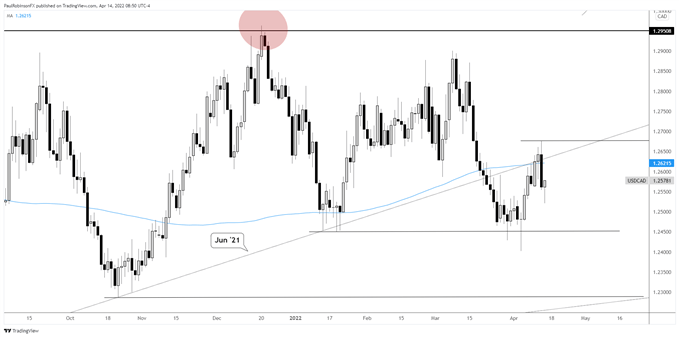

- USD/CAD declining into big support

- Could help bring clarity, but price is still stuck in a big-picture wedge

USD/CAD Technical Outlook: Trying to Find Footing After Swift Reversal

USD/CAD attempted to stay above the 200-day moving average, but was swatted down hard after trying to further cross the underside of a trend-line dating to the June 2021 low. The outlook at the moment is murky, but we do have defined top and bottom-side levels to pay close attention to.

The rise off the low began after taking out the yearly low and then reversing sharply higher. The fact that it held on a daily closing basis with a volatile turnaround continues to give validity to the yearly low at 12450.

The ultimate low of the move was 12402, which if breached will have USD/CAD looking at the low from October at 12288 and a trend-line from 2015. That would be a big spot to see USD/CAD to trade, but a bit of a distance from current levels to worry about now.

On the top-side the rejection from over the 200-day at the June 2021 trend-line has yesterday’s high at 12676 in focus as the next big hurdle to watch. A crossing of that level would put USD/CAD in position to continue further towards the 12900/50 area.

The thinking right now is that we may see USD/CAD bobble around sideways between the aforementioned levels before any meaningful move develops. Trading off these levels with a mean reversion approach may be the best stance for the time being.

USD/CAD Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

[ad_2]

Source link