[ad_1]

The fate of the U.S. consumer is weighing on the outlook for markets in 2023.

“The issue is that consumers are actually spending at a pace that is faster than their income growth, and have been for the last six or nine months,” said Bob Elliott, co-founder, chief executive officer and chief investment officer of Unlimited Funds, in a phone interview.

They’re drawing down on savings, which peaked at around $2 trillion after piling up as a result of massive fiscal stimulus that came in response to the COVID-19 crisis, according to Elliott, a former executive at macro hedge-fund firm Bridgewater Associates. Consumers probably are about halfway through that drawdown, he estimated, and “then it’s going to become more difficult for them to keep up their spending” pace.

“This bear market is well underway, but not yet complete,” Citi Global Wealth said in its outlook for 2023. “Historically, a new bull market has never begun before a recession has even started.”

But a recession might not happen as quickly as many stock and bond investors seem to fear, according to Elliott, who expects “recessionary dynamics” to emerge in the second half of 2023 as dried-up consumer savings then leads to a fall in spending.

The “flood of money” into the bond market in recent weeks “would make a lot of sense if we were very close to a recession,” he said. “But we’re not close to a recession, based upon the labor market and consumer spending behavior.”

The Vanguard Long-term Treasury ETF

VGLT,

which invests in long-term U.S. Treasury bonds, has lost 25.2% this year on a total return basis through Dec. 12, according to FactSet data. In recent weeks, though, shares of the fund rallied.

Deutsche Bank’s survey of the global financial market conducted Dec. 7-9 found that most respondents are expecting a recession to begin next year, with 67% of those anticipating a 2023 economic contraction saying it would begin during the first half, according to a research report from the bank emailed this week. Forty-eight percent of those expecting a recession next year said it would start in the second quarter, the survey shows.

Jim Reid, Deutsche Bank’s head of thematic research, expects a recession later in 2023.

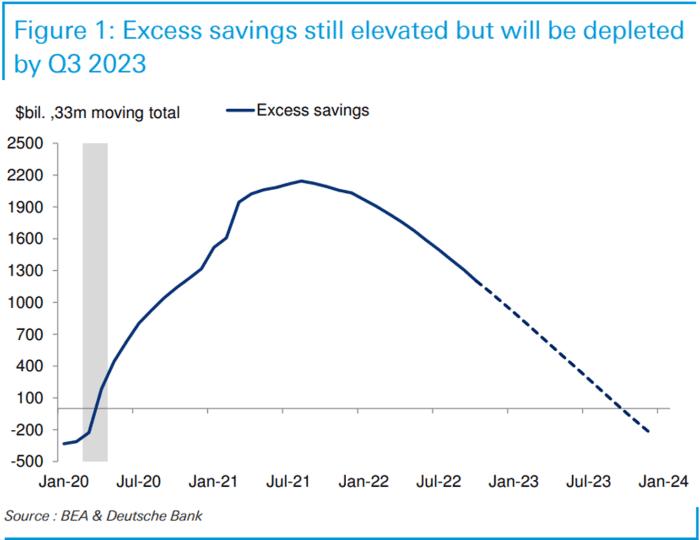

“One of the reasons we’ve felt confident that the U.S. economy wouldn’t slip into recession in 2022 and early 2023 — even though we’ve been convinced that it will by the end of 2023 — is the huge pool of excess savings and when they’ll be eroded,” Reid said in a note emailed Dec. 5.

DEUTCHE BANK RESEARCH NOTE EMAILED DEC. 5, 2022

“The consumer remains supported by a historically enormous” $1.2 trillion stock of excess savings as well as a strong labor market, he said. “If we’re correct about a recession starting” in the third quarter, “then the entire stock will be depleted by the end of that quarter.”

Stocks and bonds have been battered in 2022 amid anxiety over the Federal Reserve’s decisions to raise interest rates in its battle to tame high inflation in the U.S. The Fed’s rapid pace of rate hikes has stoked fears that it may overtighten its monetary policy and cause a recession, though at least for now, the labor market remains strong.

The S&P 500 index, a gauge of the performance of U.S. large-cap stocks, has dropped 16.3% this year through Dec. 12, tumbling as rates rose. The index is on pace for its worst year since 2008, when the stock market was reeling from the global financial crisis, FactSet data show.

Company earnings might hold up better than people may be expecting in early 2023, according to Elliott. “The strength of the consumer means that we’re probably not going to see a meaningful earnings deterioration hit quickly,” he said.

John Butters, senior earnings analyst at FactSet, said in a note this week that “industry analysts in aggregate predict the S&P 500 will have a closing price of 4,493.50 in 12 months,” describing it as a “bottom-up target price” as of Dec. 8.

That’s above the S&P 500’s

SPX,

trading level of around 4,017 on Tuesday afternoon, as investors digested fresh data showing inflation in November was softer than expected, according to FactSet data, at last check.

‘Consumer outlook is critical’

Consumers have so far been resilient amid the soaring cost of living in the U.S.

Inflation, as measured by the consumer-price index, edged up 0.1% in November for a year-over-year rate of 7.1%, according to a report Tuesday from the U.S. Bureau of Labor Statistics. The rise in inflation last month was less than expected, while the year-over-year rate has fallen from this year’s peak of 9.1% in June.

“The consumer outlook is critical in terms of the overall macro picture,” Brendan Murphy, head of global fixed income for North America at Insight Investment, said by phone. A “huge question for the Fed, and for markets, is to what extent the rate hikes that have been delivered to this point feed through and actually bite on the consumer.”

Murphy, whose base case is for no U.S. recession in 2023, said he expects next year to be a “very attractive environment for income” as investors may earn 5% – 6% yields in higher-quality parts of the bond market.

It’s hard to know at this point whether stocks or bonds will outperform in 2023, according to David Bailin, chief investment officer for Citi Global Wealth. Bailin said in a phone interview that he expects bonds to fare better in the first half of next year, with late 2023 potentially favoring stocks.

“The reason is that you’re going to have peak rates early in the year, and then ultimately rates will fall once unemployment gets higher,” he said, referring to the Fed’s benchmark rate.

“The first thing you need is to have a conservative stock and bond portfolio,” said Bailin, pointing to investments in defensive equities such as pharmaceuticals and higher-quality fixed income.

“And then you have to let that evolve over the course of the year,” allocating to riskier stocks in areas like technology should the Fed cut rates after unemployment picks up, he said. That’s because, in his view, the market would then start looking ahead to the potential recession’s end.

[ad_2]

Source link