[ad_1]

The many advisers forecasting a “Santa Claus rally” for U.S. stocks are too eager. That’s because the only year-end seasonal strength worthy of being called a Santa Claus rally doesn’t begin until after Christmas. The Thanksgiving-until-Christmas period does not itself exhibit any statistically significant rally potential.

To be sure, none of the advisers forecasting a Santa Claus rally after Thanksgiving bother to define exactly when it is supposed to begin and end. So refuting it is tricky. To do so, I measured the Dow Jones Industrial Average’s

DJIA,

gain from Thanksgiving to its highest close in December. Though you would need perfect clairvoyance in order to realize this gain, it represents the theoretical maximum for such a rally.

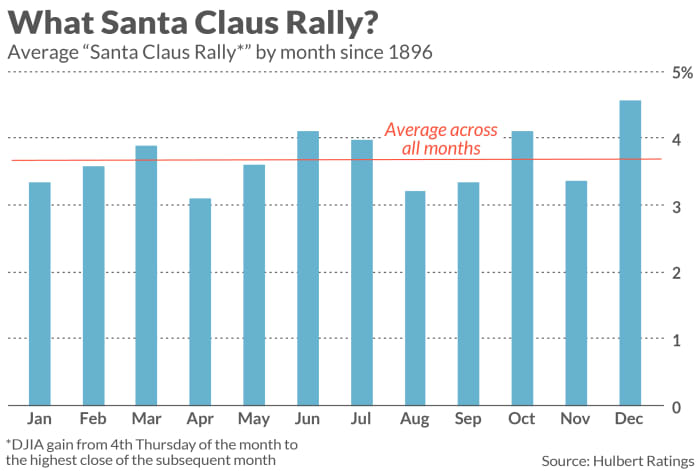

Since 1896, when the Dow was created, its average gain when measured this way is 3.35%. That may appear impressive — the equivalent of more than 1,100 Dow points currently —but isn’t really. When other months’ rally potentials are measured in a similar way, many exceed that of the post-Thanksgiving period.

This is illustrated in the chart below. To construct it, I calculated for each month the average rally from its fourth Thursday (the equivalent of Thanksgiving) to the subsequent month’s high. As you can see, seven other months have a larger rally potential than for the period that begins after Thanksgiving.

In fact, the post-Thanksgiving rally potential (shown in the November bar) is below the 3.75% average across the other 11 months of the calendar. In other words, the several-week post-Thanksgiving period is actually a below-average time for the stock market.

Investors’ holiday cheer

Not all hope is lost. The several-day period beginning after Christmas does exhibit abnormal strength. According to the Stock Traders Almanac, this genuine Santa Claus rally period lasts from the first trading session after Christmas and continues through the second trading session of the New Year. The Dow over this period has risen in 77% of the years since the index was created in 1896, and produced an average gain of 1.5%. Across all other periods of equal length over the last 126 years, the Dow has risen 56% of the time and produced an average gain of just 0.2%. These differences are statistically significant.

Also encouraging is that this tendency is stronger in years, like this year, in which the stock market lost ground year-to-date until Christmas. On average across all such years since 1896, the Dow from Christmas until the second day of January gained 2.2%. That compares to a 1.2% average gain in years in which the stock market produced a year-to-date gain up until Christmas.

So, please, let’s not take Santa’s good name in vain. He has enough on his hands already without being held responsible for the stock market’s pre-Christmas performance. History suggests that a Santa Claus rally won’t arrive until Christmas, just like the big man himself.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Fed eyes slower rate hikes as recession threat grows

Plus: What Black Friday and Cyber Monday sales tell you about retail stocks, recession and the economy

[ad_2]

Source link